The global refining industry is undergoing significant transformations driven by evolving energy demand, regulatory pressures, and technological advancements. Large, integrated refineries in Asia and the Middle East dominate the market due to economies of scale, advanced configurations, and petrochemical integration. Conversely, smaller, older refineries find it challenging to remain competitive. Oil demand growth is slowing as cleaner energy sources gain traction. While refining capacity is expected to increase by 3.3 mb/d by 2030, more than 75% of new demand will be met by non-refined fuels such as NGLs and biofuels. Gasoline demand is declining as electric vehicle adoption grows (driven by small vehicles, electric motorcycles and bicycles in the developing world), while petrochemical feedstock demand increases, primarily supplied by NGLs rather than refined oil products.

Refinery margins are under pressure, particularly in mature markets where high operating costs and strict regulations create additional financial burdens. Smaller refineries face significant competitive disadvantages compared to larger, integrated facilities. Mega-refineries benefit from lower per-barrel processing costs, greater crude sourcing power, and the flexibility to process diverse feedstocks. Stricter environmental regulations further challenge smaller refineries, which struggle with infrastructure limitations and technological gaps. Many refineries are burdened by outdated equipment that often cannot be replaced due to prohibitive costs or environmental constraints. Without substantial investments in facility upgrades and advanced digital monitoring solutions to boost efficiency and cut downtime, many smaller refineries face the very real risk of closure amid a consolidating industry.

To remain viable, smaller refineries must implement targeted strategies to reduce costs and increase profitability by improving efficiency, optimizing feedstock costs, introducing feedstock flexibility to their crude diets, and leveraging advanced technologies:

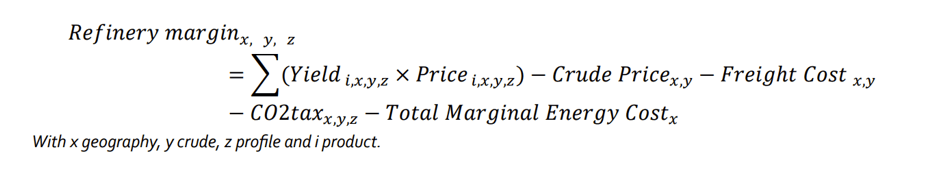

Figure 1 – Refinery Margin

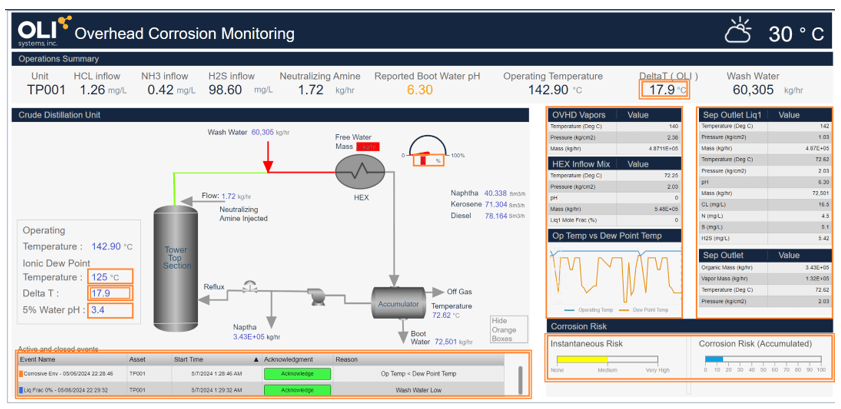

Maximizing refinery utilization, minimizing unplanned shutdowns, and optimizing operations through real-time monitoring are essential for profitability. Digital solutions like OLI’s Systems’ Corrosion Digital Twin empower refineries to maintain performance within safe limits, swiftly detect deviations in real time, and make proactive adjustments to avert costly failures. Additionally, predictive analytics evaluate corrosive environments, monitor key indicators, and establish Integrity Operating Windows—helping refineries prevent corrosion-related issues, refine chemical treatment strategies, and extend asset lifespans. Refineries can avoid unplanned outages by accurately forecasting equipment health and maintenance needs, thereby reducing financial and production losses. Feedstock cost management is critical with crude oil accounting for over 80% of a refinery’s cash operating expenses. While smaller refiners lack the purchasing power of larger players, they can take advantage of regional price fluctuations. Increasing hs. The rise of U.S. light-tight oils presents an opportunity, as refining lighter, low-sulfur crudes meet market specifications and supports petrochemical production without requiring extensive facility upgrades.

Rather than competing in bulk fuel markets, some small refineries focus on high-margin niche products such as marine fuels, aviation gasoline, lubricants, waxes, and petrochemical feedstocks. In the U.S., however, many regional refineries continue to survive by supplying bulk fuels to the specific regions they serve. For these refiners, feedstock flexibility is often limited, but operational flexibility can be key to improving profitability and maintaining regional relevance. These specialized markets often offer higher profitability than conventional refining. Biofuels and renewable fuels present additional opportunities, particularly as smaller refineries are well-positioned to integrate regional bio-feedstock supplies. Moving toward renewable diesel production allows refiners to benefit from policy incentives and early-move advantages. However, bio-based feedstocks introduce challenges like corrosion and fouling risks. OLI’s software helps refineries proactively manage the corrosion and fouling risks associated with processing lower-quality feedstocks. This enables refineries to take advantage of the cost benefits of opportunity crudes or bio-based feedstocks while still maintaining the reliability of higher-quality crude stocks.

Refineries are put in the position of protecting their assets at all costs while maintaining the flexibility of processing riskier feedstocks. With these risks the wait and see approach to process control is no longer viable, digital transformation must be adopted for refineries to remain competitive. OLI’s Corrosion Digital Twin provides real-time insights into refinery assets, helping operators mitigate corrosion before it occurs and avoid costly shutdowns. A refinery leveraging OLI’s’ first-principles model successfully introduced opportunity crudes into its slate, reducing feedstock costs, lowering operating expenses, and maintaining long-term reliability.

Figure 2 – OLI Systems Corrosion Digital Twin – CDU OVHD

The best path forward for small refiners depends on regional dynamics, feedstock availability, and market conditions. Some will succeed by targeting niche markets or renewable fuels, while others will pursue partnerships or invest in greater complexity to handle lower-cost crude. Regardless of the approach, cost efficiency, advanced technology adoption, and strategic differentiation will be essential in shaping a sustainable business model.

The refining industry will continue to be dominated by extensive, complex facilities, but opportunities remain for agile refiners who embrace innovation. The key to long-term survival lies in a relentless focus on operational excellence, cost control, and forward-thinking investments in digital transformation. OLI’s advanced predictive analytics, digital twin technology, and corrosion modeling solutions provide refineries with the tools to optimize efficiency, enhance asset reliability, and mitigate risks associated with processing opportunity crudes and renewable fuels. By leveraging OLI’s expertise, refiners can proactively manage process integrity, extend equipment lifespan, and make data-driven decisions that improve profitability. As the refining landscape evolves, those who integrate cutting-edge digital solutions will have a competitive edge, ensuring long-term resilience and sustainability in a challenging market.

OLI is a strategic partner in this transformation, enabling refineries to navigate uncertainty, maximize efficiency, and unlock new growth opportunities.

To learn more and share ideas on this topic, contact us.